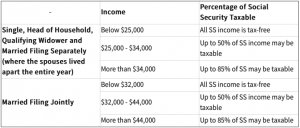

A major point of frustration for many retirees is paying tax on their Social Security benefits. In some cases an individual or married couple will exceed the income thresholds with pension income and cannot do anything about the tax of their Social Security, but they may be able to control how much of their Social Security is taxed. In other cases by doing some strategic planning, the entire tax on Social Security can be eliminated. Let’s dive into how the tax on Social Security works. The table below shows the income levels and the percentage of tax for single and married couples:

A major point of frustration for many retirees is paying tax on their Social Security benefits. In some cases an individual or married couple will exceed the income thresholds with pension income and cannot do anything about the tax of their Social Security, but they may be able to control how much of their Social Security is taxed. In other cases by doing some strategic planning, the entire tax on Social Security can be eliminated. Let’s dive into how the tax on Social Security works. The table below shows the income levels and the percentage of tax for single and married couples:

Calculating Your Income

The first step in calculating the tax on Social Security, is to calculate your modified adjusted gross income (MAGI). To do this first take your adjusted gross income, and add any tax exempt interest, miscellaneous tax free fringe benefits and exclusions, and then add 50% of your Social Security income. Once the amount is determined look at the schedule and see if you are above the income amounts for the 50 and 85% tax.

Using Annuities to Avoid Taxes on Social Security

In a lot of cases it is interest income, whether tax free or taxable, that can cause a higher amount of your Social Security to be taxed. If instead the interest earnings are converted to tax deferred interest, by using an annuity, and the earnings are left in the account, then this will eliminate interest earning from the MAGI calculation.

An example of this is if an investor had stock dividends of 3% on $250,000, or $7,500 of dividend interest income that would be counted as income for his MAGI. By instead using an annuity, and supposing the same $250,000 earned 3%, then the $7,500 in annuity gains if left in the annuity, would not count in calculating the MAGI.

Let’s look at some examples to see how this works:

Example 1

Frank Peterson is a single retired person age 72, and he has $19,500 of pension income, and $3,000 of interest income from his bonds. He receives $10,000 in Social Security income. So adding this all together and (using 50% of his Social Security in the MAGI calculation):

($19,500+$3,000+$5,000= $27,500.

Since his modified adjusted gross income is above $25,000, he will have to pay taxes on up to 50% of his Social Security income.

If Frank instead of using bonds, used an annuity, and did not take the income but left it in the annuity, then he would have reduced his MAGI from $27,500 to $24,500, and therefore would not have reached the $25,000 income level, which for a single person causes a tax on 50% of their Social Security income.

Example 2

James and Linda Wright both 68, have earned income of $27,500. They have income from their investment portfolio of $7,500 in the form of dividends and interest. Their Social Security income between them is $21,000. Calculating their MAGI, ($27,500+$7,500+$10,500), they have $45,500, which causes a tax of 85% of their Social Security.

IF again the dividend and interest income was in an annuity an not withdrawn, then their MAGI would be reduced to $38,000 and only causing 50% of their Social Security to be taxed instead of 85%.

Annuities are Tax Deferred

Don’t forget the valuable benefit of the tax deferred aspect of an annuity. Even if the tax on Social Security cannot be reduced because of your particular situation, keep in mind that simply sheltering ordinary interest and dividends from taxes every year can help to reduce your tax bill. Also if you have an above average income don’t forget about the Medicare surtax of 3.8% on individuals above $200,000 and $250,000 for married couples. Sheltering portfolio income into an annuity can also help to reduce or eliminate this tax as well.